China's carbon trading system may become the world's largest carbon market

Jul 09, 2021As the issue of climate warming has become the focus of attention, how to deal with climate warming and effectively reduce carbon emissions has also become an important issue for the international community.

What is the carbon pricing?

Carbon pricing is a tool to reduce greenhouse gas emissions. It can record the external cost of greenhouse gas emissions, that is, the emission costs paid by the public, such as the cost of crop damage, the cost of health care caused by drought and warming, and the property caused by floods. Losses and the impact of rising sea levels, etc., these costs will be revealed by pricing the carbon dioxide emitted. This pricing method helps to transfer the burden of damage caused by greenhouse gas emissions to those who are responsible or who can reduce carbon dioxide emissions, such as factories and companies that emit carbon dioxide. Carbon pricing does not determine who should emit where and how to reduce emissions, but provides economic signals to emitters and allows them to decide to change their activities and reduce their emissions, or continue to emit but pay for their emissions at the same time. In this way, global environmental goals can be achieved in the most flexible and cost-effective way. Setting appropriate prices in greenhouse gas emissions is fundamental to internalizing the external costs of climate change when formulating economic incentives for clean development.

The main type of carbon pricing

Carbon pricing can take different forms and methods. The main methods are emissions trading systems and carbon taxes. Other types include carbon pricing offset mechanisms, outcome-based climate financing, and internal negotiation prices set by organizations.

1. Carbon Emission Trading System (ETS)

The carbon emission trading system is a market-based energy saving and emission reduction policy tool. Emissions units can be traded to meet their emission targets. Companies included in the carbon trading system need to have a carbon emission allowance for every ton of carbon dioxide emitted. These companies can implement internal emission reduction measures to reduce emissions, obtain or purchase these allowances, or trade allowances with other companies. The specific choice will depend on the relative cost of each option. By creating the supply and demand of carbon emission units, the market price of carbon emission is formed. There are two main types of ETS: Capand trade and Baseline and credit.

2. Carbon Tax

Carbon tax is a type of tax levied on fossil fuels (such as oil, coal, natural gas) based on its carbon content or the proportion of carbon emissions. Although both carbon tax and carbon trading are adjustment methods based on market mechanisms, they are quite different.

3. Other types

Carbon offset refers to individuals or organizations providing corresponding funds to carbon dioxide emission reduction projects to offset their own carbon dioxide emissions. These funds will be given to specialized enterprises or institutions, who will offset the corresponding amount of carbon dioxide in the atmosphere through tree planting or other environmental protection projects. This approach can be limited to domestic or global scope.

The development state of carbon pricing in our country

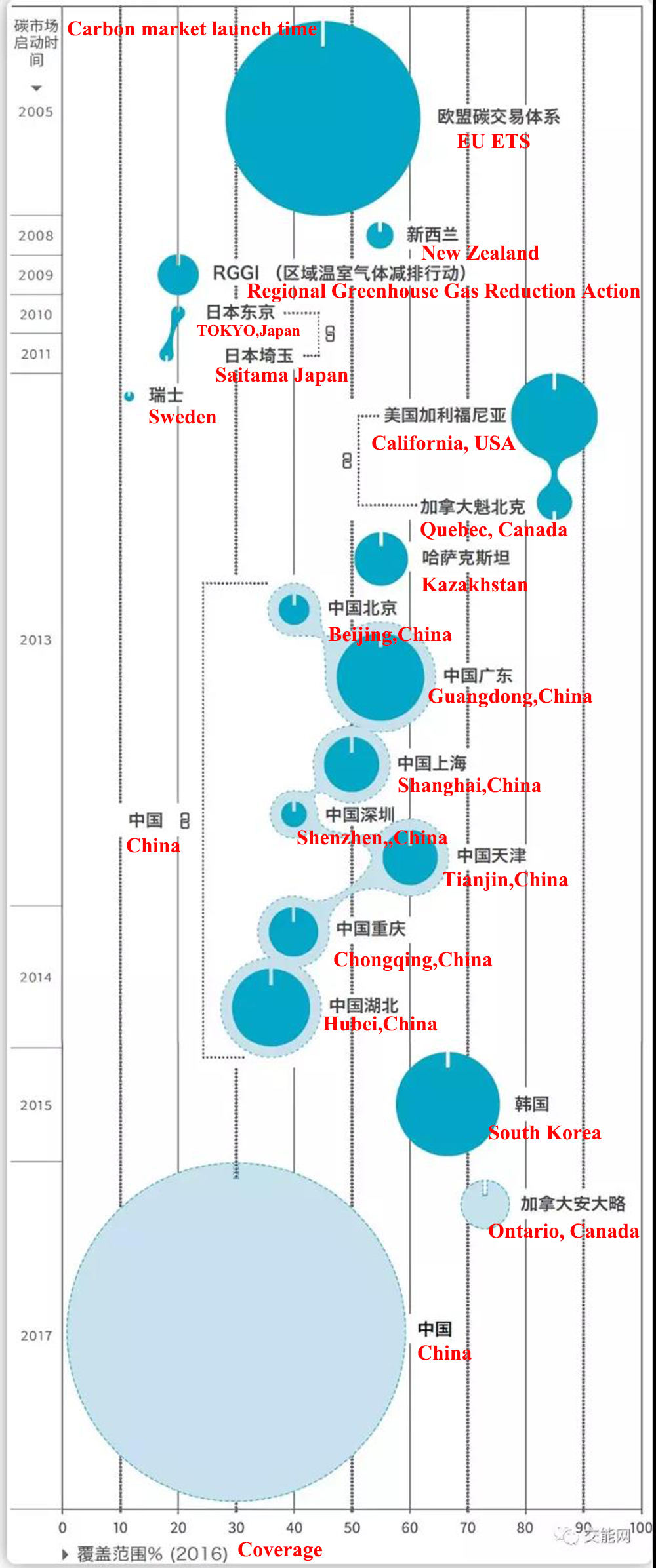

China’s current carbon trading market is still in the early stages of construction. Taking the CDM project in the Kyoto Protocol as the starting point, it is divided into three phases: the clean development mechanism phase (2002-2011), the pilot trading phase (2011-2017) and National transaction stage (2017 to present).

In the pilot phase, carbon allowances will be traded. The types of transactions are local quota spot and China's certified emission reduction (ccer) spot, with local quotas as the leading factor. Since 2011, 7 carbon trading pilot projects have been launched in Beijing, Tianjin, Shanghai, Chongqing, Guangdong, Hubei, and Shenzhen. Since the launch of the seven pilot projects, the carbon trading market has been very active. As of December 31, 2017, the cumulative trading volume of the seven pilot carbon markets and Fujian carbon market quotas was 185 million tons.

On December 18, 2017, the National Development and Reform Commission issued the "National Carbon Emission Trading Market Construction Plan (Power Generation Industry)", which officially launched the carbon emissions trading system and formulated a roadmap for the national emissions trading system. The ETS roadmap includes two phases: infrastructure development and simulated trading. The infrastructure construction phase lasts about one year and is focused on completing the legal foundation and market support system for China's ETS, including the trading platform, registration system and data reporting system. The next phase is expected to last for one year, and the power sector will use the spot market to participate in simulated transactions.

Therefore, based on the results of the simulation phase, the emissions trading system will gradually expand to seven other areas: aviation, construction materials, chemicals, steel, non-ferrous metals, pulp and paper, and petrochemical products. Once put into operation, my country is expected to have the world's largest carbon market, and its impact on global carbon emissions is also huge, covering more than 5% of global greenhouse gas emissions.