2. The profit quality is high-quality, and the valuation advantage under high R&D may welcome Davis to double-click

High-quality corporate profits can lay a good asset foundation for the future development of the company. The performance of Yuanchen Technology’s financial report this time also makes people more confident in its future growth.

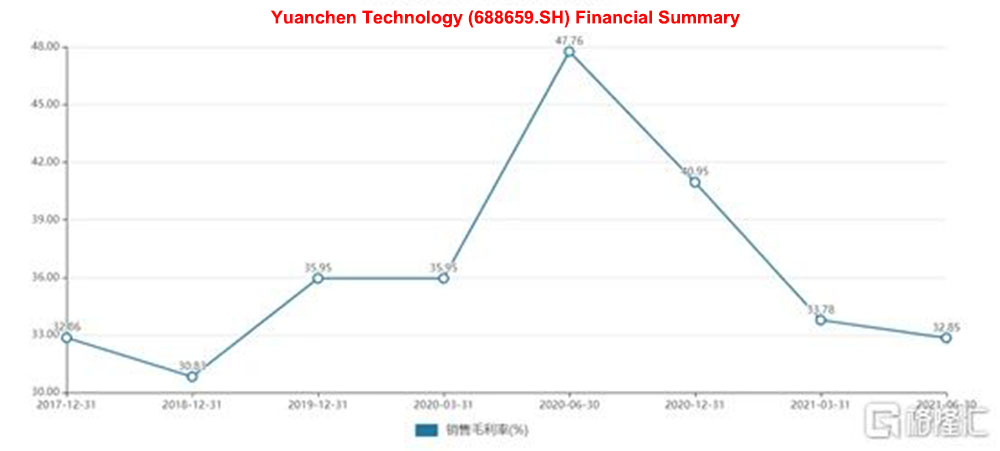

The decline in Yuanchen Technology's gross profit margin is only a short-term impact, and the predictability will be restored in the later period and it can open up the upward space again. According to the interim report, the company's 2021 half-year operating cost was 150 million, a year-on-year increase of 63.1%, which was higher than the growth rate of operating income of 26.9%, resulting in a 14.9% year-on-year decrease in gross profit margin.

We can find the reason from the expense side: management expenses increased by 41% compared with the previous quarter. As a company listed on the Sci-tech Innovation Board at the end of March, in addition to the increase in employee compensation, a large part of it is the increase in listing-related expenses. Sales expenses only increased by 3.66%, but in the past three years, Yuanchen Technology has continued to grow in this indicator, and it has even doubled from 2019 to 2017.

These data directly demonstrate the above two growth points of Yuanchen Technology, namely: non-electric business and third-party testing, and the expenses incurred in the current vigorous expansion, such as sales team and promotion expenses. In this interim report, strategic cooperation has been reached with many well-known brands.

With the development of high value-added products in the non-electricity market strategy, the industry itself has technical barriers and qualification barriers enough to form a long-term and stable relationship with customers in the later period, so the short-term increase in sales expenses is understandable for the development of this company .

On the other hand, R&D investment continues to increase. According to the interim report, Yuanchen Technology's R&D investment accounted for 6.39% of revenue, which was an increase of 0.31 percentage points from 6.08% in the previous quarter.

Moreover, R&D investment has continued to grow in the past five years, which has ensured the competitiveness of enterprises. According to the data, from 2017 to 2020, the company's R&D expenses reached 13.484 million yuan, 16.398 million yuan, 19.0582 million yuan, and 25,429,100 yuan, respectively, accounting for 5.05%, 5.06%, 5.25% and 5.54% of operating income in the same period.

Yuanchen Technology has a very mature research and development model. It has established the Science and Technology Research Institute and formed a standardized project-based research and development system with independent research and development as the mainstay and cooperative research and development as the supplement.

After a strict feasibility study by the Science and Technology Research Institute, it is ensured that the research and development projects are in line with the company's business development direction. According to the company's strategic development needs, the R&D department regularly evaluates and analyzes the progress of R&D projects and the external environment, and formulates R&D plans that are compatible with the company's strategic development. The company's research and development system includes three closely related subsystems: product development strategy planning research system, technology research and development and product research and development system, product pilot system.

At present, Yuanchen Technology has formed a certain technological advantage in the field of environmental protection products of new flue gas purification and filtration materials. In terms of dust removal filter material products, the company independently innovated core technologies such as ultra-clean electric bag asymmetric gradient technology, PTFE composite emulsion membrane technology, and integrated dust removal and denitrification technology. Taking the ultra-clean electric bag asymmetric gradient technology as an example, the company uses This technology has developed a new type of high-efficiency ultra-low emission filter material for coal-fired power plants, obtained high-tech products from Anhui Province, and passed the evaluation of scientific and technological achievements by the China High-tech Industrialization Research Association. The products have been successfully used in domestic coal-fired power units of 1000MW, 600MW and above. Application to achieve ultra-clean emissions.

In the field of denitration catalyst products, the company currently has high-efficiency SCR denitrification technology for power plants, nitrogen oxide-dioxin removal technology, etc., and the industrialization project of the above-mentioned technology "Industrial exhaust gas denitrification key technology research and industrialization" has been awarded by Anhui Science Second prize for technological progress.

It is worth mentioning that not only has the development of ceramic fiber membrane filter research and development, ultra-low temperature SCR denitrification catalyst research and development and other projects under development, but also proposed a detailed plan for the research and development direction in the next 3 to 5 years, and the relevant technical reserves have Certainly forward-looking; in addition, the company has established a multi-level and multi-faceted technical cooperation relationship with many universities and scientific research institutions.

According to the latest information, there are laboratories with advanced equipment and complete functions, with CNAS and CMA qualifications. The company has 89 authorized patents, including 27 invention patents, 61 utility models, and 1 design patent. The continuous deepening of research and development will become a strong engine for the continuous growth of the company's business.

At the same time, in terms of overall profitability, Yuanchen Technology ranks in the forefront in terms of net profit margin and gross profit margin compared to other listed companies with environmental protection treatment equipment. And with the development of circular economy business in the future, the expected rebound in gross profit margin is visible, and it is even expected to exceed the high point in 2020.

Summary: The rise of a company's stock price is driven by performance gains, and also driven by rising valuations, that is, Davis double-clicks. In terms of investment, to make money for business growth, you need to be insensitive to price fluctuations and have a deep understanding of business models. This is a game of foresight. Since it is to make money for growth, you must hold this patiently. Stocks, wait for growth to appear (essentially cash flow in the future).

As of the end of expiration, Yuanchen Technology had total assets of 919 million yuan, an increase of 33.64% from the end of the previous year; net assets attributable to shareholders of listed companies were 615 million yuan, an increase of 55.25% from the end of the previous year.

As the two major businesses begin to materialize in the future, this company is not only a high-quality environmentally friendly new material company, but also has the high valuation advantage of technology stocks. As the sci-tech innovation board continues to be sought after by the market trend, the value of Yuanchen Technology's steady growth will continue to be highlighted.